We Adopted a 4-Year-Old Girl.

— A Month Later, She Looked at Me and Said: “Mommy, Don’t Trust Daddy”

It had only been a month since Jennifer became part of our family. After years of trying, frustrations, and paperwork, Richard and I finally brought home that little girl with observant eyes and a timid voice. She was just four years old—tiny and quiet—but her gaze spoke louder than words. And I was ready to love her with everything I had.

Richard seemed just as fulfilled. He watched Jennifer like she was the most precious thing he had ever seen.

— “She’s perfect, Marla,” he whispered.

— “She really is,” I agreed with a soft smile, watching our daughter snuggle beside me.

The first days were all about adjustment. Jennifer was reserved, especially with Richard. He tried to play, to get close, but she hid behind me, responding only with nods or silence. I thought it was normal—just part of the process.

One afternoon, we went out for ice cream. Richard enthusiastically invited her, but Jennifer hesitated before accepting—and only did so after I nodded. At the shop, she asked, almost in a whisper, “Vanilla, please,” avoiding eye contact with him.

Later that evening, as I tucked her into bed, Jennifer clung to my arm.

— “Mommy?”

— “Yes, sweetheart?”

She looked at me seriously and said:

— “Don’t trust Daddy.”

Those words froze me.

— “Why, my love?”

— “He talks funny… like he’s hiding something,” she replied with a sad little frown.

I tried to reassure her, saying Richard just wanted her to feel safe. But even after she fell asleep, something about it stayed with me.

The next morning, while I was making dinner, I heard Richard talking on the phone in the living room:

— “It’s been harder than I expected… She notices more than I thought she would. I’m afraid she’ll tell Marla…”

My heart raced. What didn’t he want me to know? What could Jennifer tell me?

Later, I confronted Richard in the living room.

— “I heard you on the phone.”

— “What exactly did you hear?” he asked, surprised.

I told him everything. He looked at me for a moment and then, taking my hand, confessed with an embarrassed smile:

— “I was trying to plan a surprise party for Jennifer’s birthday. My brother is helping me. I didn’t want you to find out before it was ready.”

I was silent for a few seconds, processing everything. That was it? I sighed in relief, though I still felt a little silly for having doubted him.

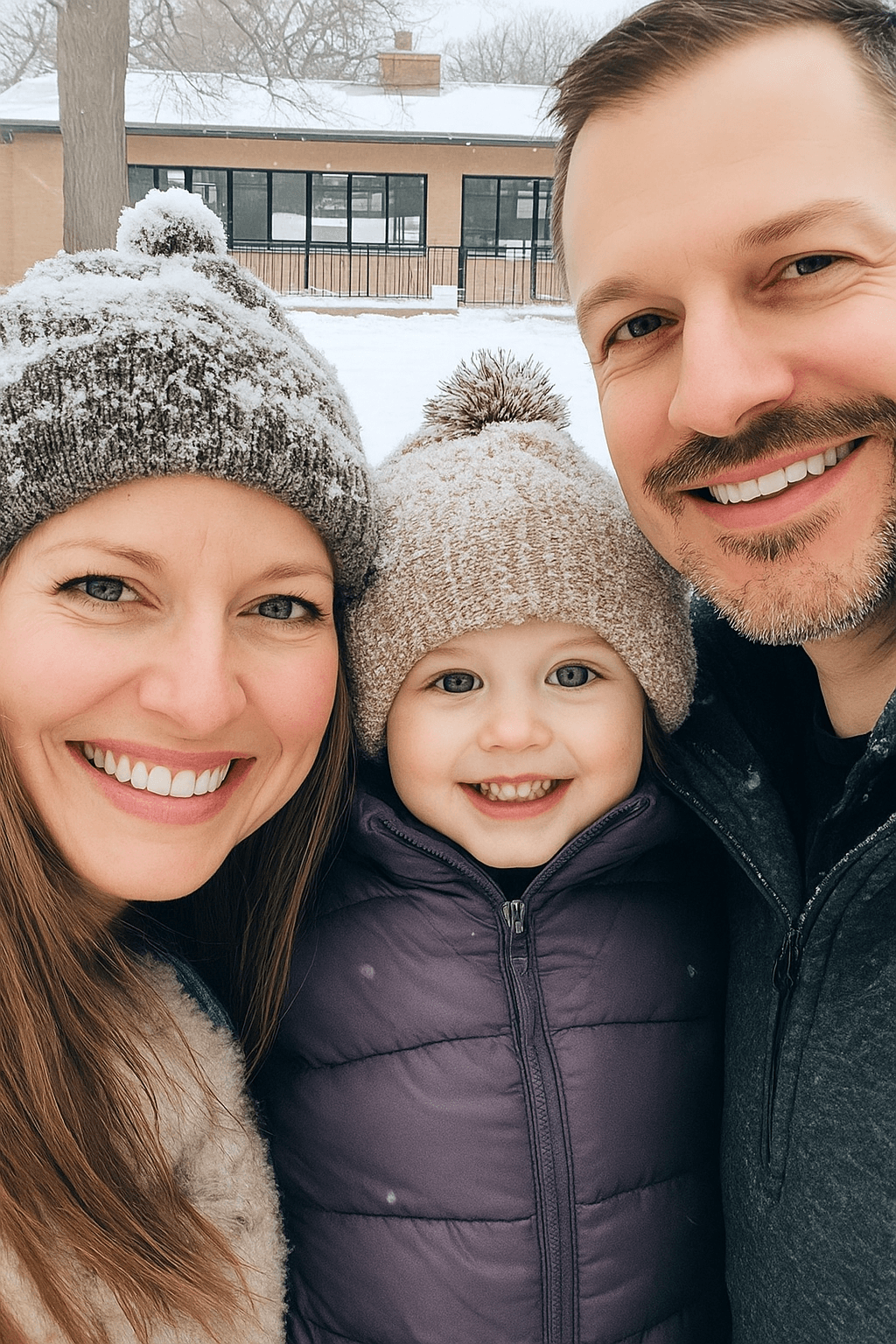

The next day, I saw Richard helping Jennifer with breakfast. She was still shy, but something had changed. She was beginning to relax. She moved closer, accepting small gestures, small smiles.

At that moment, I understood: maybe she was just testing the waters, afraid to trust again. And maybe, little by little, she was starting to realize she could—with him, and with us.

💰 Financial Loans & Broader Financial Education Awareness

In times of hardship or when a dream arises—like opening a business or paying off a high-interest debt—many people turn to personal loans. While this tool can be helpful, it requires caution, planning, and full awareness.

A loan is not extra income—it’s a long-term financial commitment. When you take out credit, you agree to repay the amount with interest and fees, which can often be high, especially with institutions that lack transparency or operate outside the regulated financial system. Before signing any contract, compare rates, read the fine print of the Total Effective Cost (TEC), and ensure the payments fit within your monthly budget.

The worst case is using loans to pay off your credit card’s revolving balance, which can create a debt spiral that’s hard to escape. Credit cards must be used with responsibility and planning. Uncontrolled use, combined with frequent loans, creates a snowball effect that damages your financial health for years.

Additionally, many people seek loans to invest in stocks, cryptocurrencies, or high-risk funds—an extremely dangerous move. Investments should always be made with your own capital, never with borrowed money. Market volatility can result in significant losses, and those who invest money they don’t actually have can drown in unpayable debt.

That’s why financial planning is essential. Controlling expenses, having an emergency fund, and setting clear goals help avoid impulsive decisions. Before seeking credit, ask yourself: “Is this expense truly necessary now? Do I have a payment plan? Will this loan help or make things worse?”

Another crucial point is protecting what you already have. Life, health, and car insurance are preventive measures that protect you from major losses during unexpected events. Having proper coverage can prevent you from needing a loan in a crisis.

If you’ve experienced an accident, a medical error, or corporate negligence, you might be entitled to compensation or a financial settlement. What seems like a dead end could be resolved with the help of a lawyer specializing in areas like accidents, consumer rights, or immigration. Knowing your rights is key to financial empowerment.

Conclusion:

Loans are not villains, but they aren’t magic solutions either. They require responsibility, information, and planning. Seek professional guidance, learn about financial education, and whenever possible, consider more sustainable alternatives before taking on new debt.