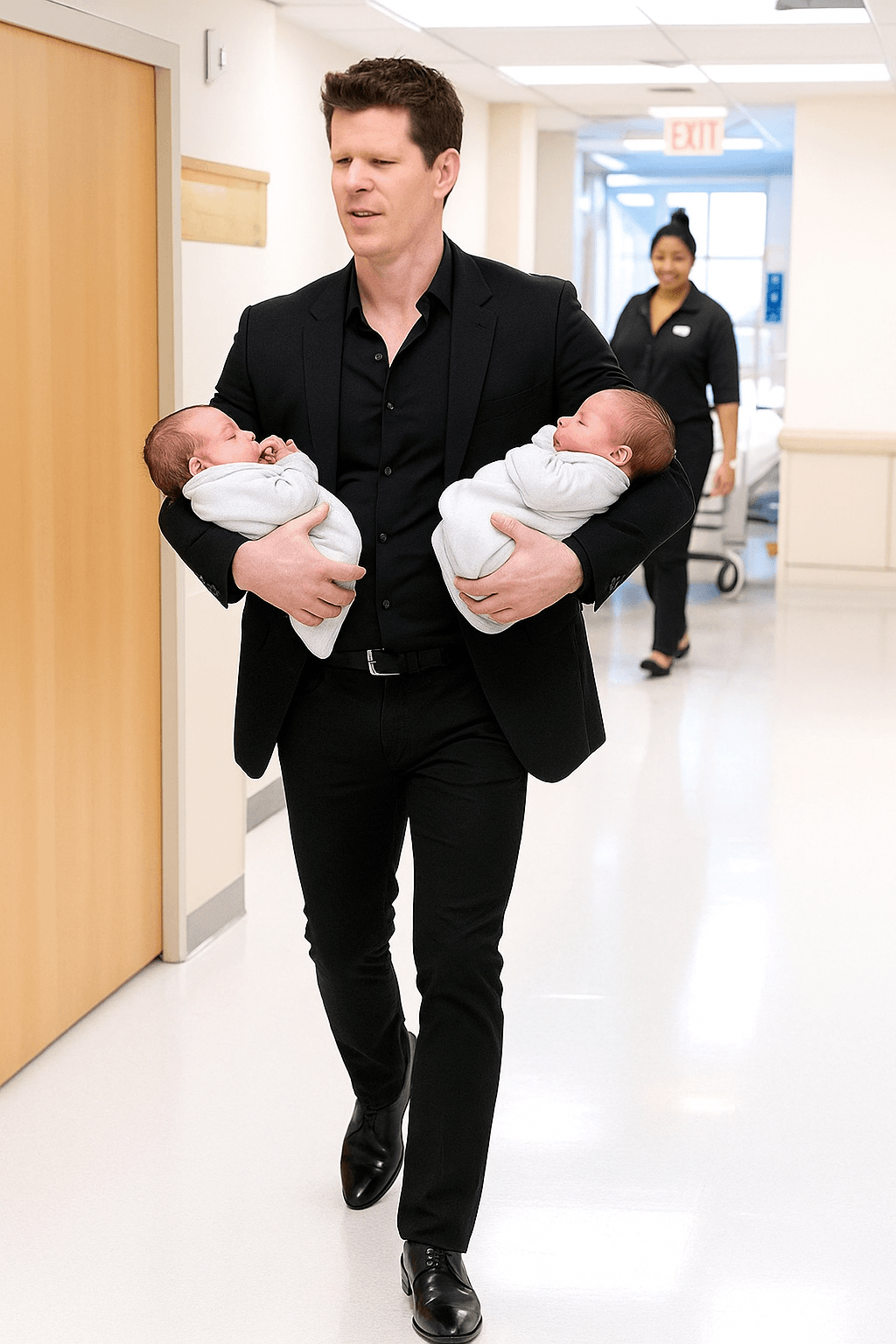

Unexpectedly, I Saw My Husband in a Luxury Suit Leaving.

a Maternity Clinic Holding Two Babies in His Arms

My life changed that day — and not because of the positive pregnancy test I held in my hands. The news of a new pregnancy brought me joy, yes, but also a heavy weight: how could we support another child when we could barely pay the bills?

Jacob, my husband, worked as a school janitor. I worked as a babysitter. Our 7-year-old son, Tommy, needed new shoes, and our car made a noise that promised an expensive repair. Even so, I kept the news to myself. Jacob already carried the weight of the world on his shoulders.

That morning, I went to the clinic for a check-up. The doctor confirmed that the pregnancy was going well. Relieved, I left his office — and that’s when everything changed.

I saw Jacob in the hallway. But it wasn’t the Jacob I knew — not the one with tired eyes and worn boots. He was wearing a luxury black suit, polished shoes, perfectly styled hair, and a shiny watch on his wrist. And in his arms? Two newborn babies wrapped in pastel blankets.

“Jacob?!” I called, confused. “What are you doing here?”

He didn’t answer. He kept walking, exited the hospital, and got into a luxurious black car. I stood frozen in shock. None of it made sense. I needed answers.

I followed the trail and entered the maternity ward. There, a stunning woman — tall, red-haired, with natural elegance — was packing an expensive designer bag. When she saw me, she asked coolly:

— Can I help you?

— I’m looking for my husband. Jacob, I said firmly. — I just saw him walk out with two babies. Are they yours?

She turned pale. — Your… husband?

— We’ve been married for nine years. We have a son, and I’m pregnant with our second child — I revealed.

She sat down, stunned. — He told me he was divorced.

We were both in shock. And it got worse when she said Jacob had claimed to be the heir of a millionaire, wooing her with luxury cars and fine dining. She had known him for two years. It was all a lie.

— My name is Clara — she finally said. — I think we both deserve the truth. Together.

We drove to her house, a luxurious estate. We found Jacob in the twins’ nursery. When he saw us, his face went pale.

— Emma? What are you doing here?

— You’re going to explain this — we both said in unison.

He confessed: two years earlier, his father had passed away and left him a $300,000 inheritance. Instead of using the money to help his family, he created a second life. He wanted a “fresh start.”

— You already had a family, Jacob — I said, my heart breaking.

Clara ended it right there. That night, Jacob left with nothing but the clothes on his back.

The following week, I filed for divorce. It wasn’t easy, but it was necessary. Tommy deserved stability. And so did I.

Days later, Clara called me. She said she needed help with the babies and offered me a job as a nanny, with housing and good pay. I accepted. After all, she had been deceived too. We both wanted to move on.

Months later, I gave birth to my daughter. Now, living with dignity, working for Clara, and raising my children in peace, I feel something I hadn’t felt in years: security.

Life betrayed me. But it also set me free.

And freedom? It was worth everything.

📌 Awareness About Personal Loans

Personal loans can be a temporary relief, but if not well planned, they turn into a debt trap. Many people resort to them to pay off other debts, make non-essential purchases, or maintain a lifestyle beyond their means.

Before applying for a loan, it’s essential to evaluate:

- The real need for credit. Is it an emergency, or could it be solved with financial reorganization?

- The contract conditions. What’s the interest rate? What is the APR (Annual Percentage Rate)? Are there hidden fees?

- The impact on your monthly budget. Can you truly afford the installment?

Many institutions offer quick credit but with sky-high interest rates. Payroll loans, for example, may seem attractive but can severely impact a worker’s salary, leading to default in other areas of life.

Tips to avoid falling into traps:

- Compare different offers before signing a contract.

- Avoid loans with abusive interest rates, such as overdrafts or credit card revolving credit.

- Never take a loan to pay off another loan — that turns into a snowball.

- Have a clear repayment plan and strict control over your financial commitments.

📚 Other important considerations:

- Investments (stocks, crypto, funds): Before investing, study, seek guidance, and understand your risk profile. Investing is not gambling.

- Financial planning: Build a monthly budget, cut unnecessary expenses, and set realistic goals.

- Insurance (life, health, car): Protect your family and assets. Insurance is not an expense — it’s prevention.

- Specialized lawyers: In cases of accidents or immigration matters, having a good lawyer can make the difference between loss and compensation.

- Compensation and claims: Know your rights. Often, you may be entitled to compensation for damages suffered — but you need knowledge to act.