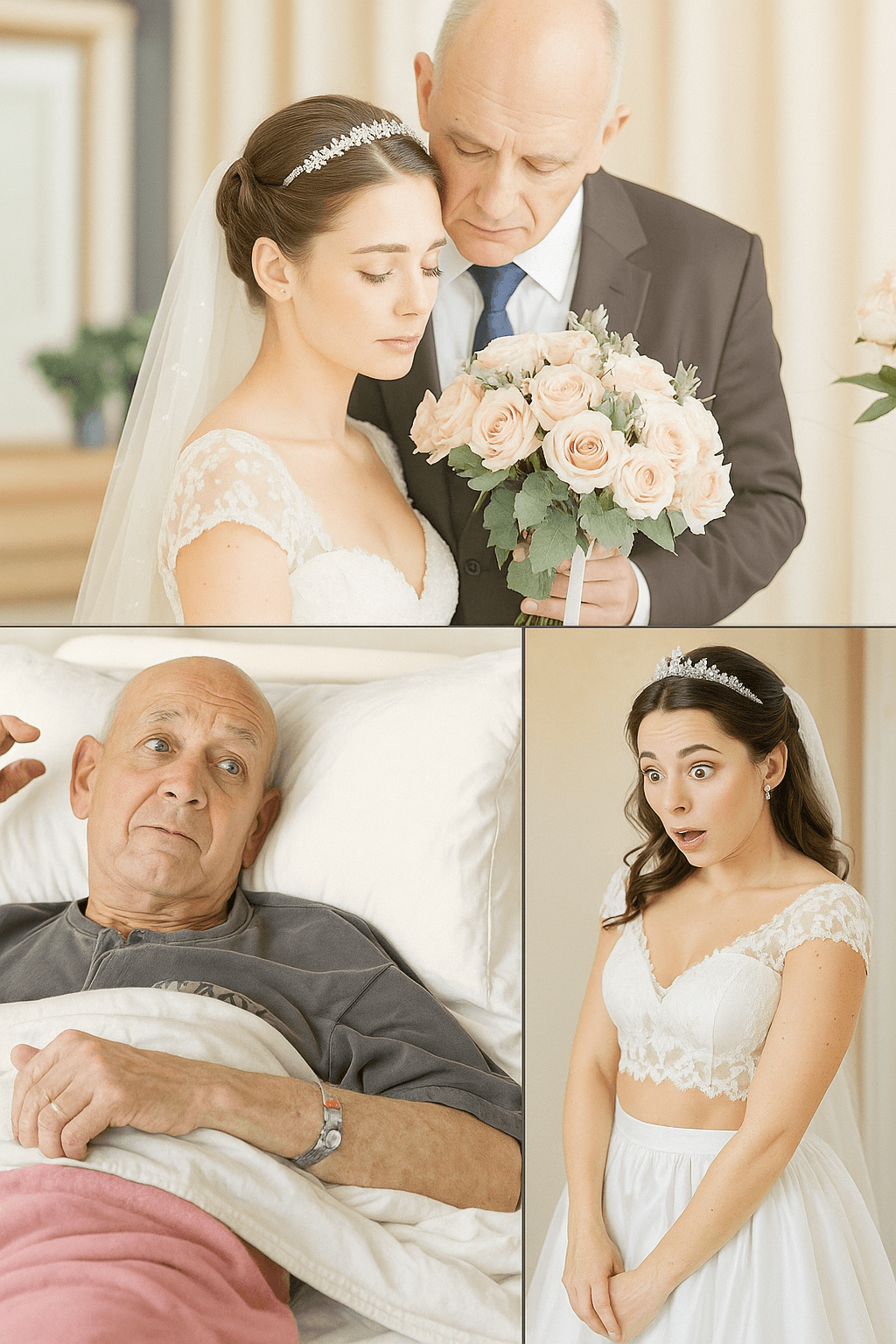

The Poor Student Who Married a 60-Year-Old Man.

— and the Request That Left Her Paralyzed

Anna was a young student from a humble background, full of dreams and plans for the future. But the harsh reality of her family had always weighed heavily on her. Her parents, tired of struggling with poverty, saw a golden opportunity when Iván Serguéyevich, a wealthy and influential 60-year-old man, showed interest in their daughter.

Iván was a man with an imposing appearance, dressed in impeccable suits and with cold gray eyes. His calm, calculating demeanor was intimidating. When he asked for Anna’s hand in marriage, her parents didn’t hesitate. For them, it was their ticket out of misery — and Anna was expected to accept out of gratitude.

The wedding was arranged quickly. During the ceremony, Anna could barely manage a smile. She felt like an object being handed from one person to another. She stood there, dressed in white, while her heart silently screamed. Her dreams of studying, traveling, and loving freely… all seemed so far away, buried under obligation.

“You are beautiful,” Iván said calmly during the reception. “I hope we can get along.”

Anna said nothing. Her eyes searched the horizon through the window, as if begging for help.

That night, alone with her new husband in the cold, silent mansion, Anna tried to mentally prepare herself. But nothing could have prepared her for what he was about to say.

Iván approached her, looked her in the eyes, and said firmly:

“I want you to call me ‘father.’”

Anna froze. Her blood ran cold. She was speechless. He went on:

“It’s not a fetish. It’s just how I’ve always seen you. I met your parents long before you were born. I watched you grow up from a distance. I always knew you would be mine. I made deals, helped your family, paid their debts. And now, you belong to me. Just as I planned.”

Anna felt the ground disappear beneath her feet. At that moment, she realized the marriage wasn’t just a cold transaction — it was the end of her freedom. She belonged to a man who had been watching her since she was a child, who saw her as a possession.

She cried silently. But amidst the despair, a seed of courage was born.

The next morning, before the sun had fully risen, Anna packed a small backpack and slipped out the back of the mansion. She didn’t look back.

She had no idea where she was going. But she knew she didn’t belong there. Her life couldn’t be shaped by anyone but herself.

Escaping wasn’t easy. She faced hunger, fear, and uncertainty. But every step she took away from Iván was a step toward freedom.

Months later, Anna was awarded a scholarship in another country. There, she rebuilt her life. She discovered her strength, her talents, and, most importantly, her worth.

She never heard from Iván again. And she never wanted to.

Anna learned that running away is not cowardice — sometimes, it’s the first act of courage by someone who refuses to be anyone’s property.

💡 Financial Awareness: Responsible Use of Loans and Credit Cards

We live in a society where access to credit has never been easier — just a few taps on a phone and you can get a new card, take out a loan, or split a purchase into installments. While this may seem like an advantage, poorly managed credit quickly becomes a serious problem. That’s why financial education and awareness are more important than ever.

📌 Credit Cards: Convenience That Can Become a Trap

The credit card is one of the most widely used financial tools. With it, you can buy now and pay later, split purchases into installments, and even earn rewards. But many people don’t realize that by using a card irresponsibly, they’re taking on debt that can grow with extremely high interest rates.

Revolving credit — triggered when the full bill isn’t paid — can exceed 400% annually, damaging a family’s budget for months or even years. Many consumers fall into this cycle without realizing it, thinking they are “paying off” the bill when they’re actually just rolling over the debt.

Tips for using your credit card responsibly:

- Never spend more than you can afford to pay in full.

- Avoid long-term installments that burden your future budget.

- Always pay the full amount of your bill.

- Track your spending using financial control apps.