The Hidden Fortune of the Evicted Adoptive Mother

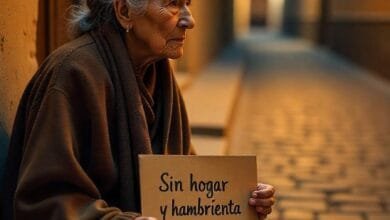

A eviction notice arrived on a rainy Tuesday afternoon. Margaret Whitmore, 78 years old, stood in the hall of the house she had maintained for decades, drenched and trembling. Her eyes fell on the signature on the document:

Andrew D. Miller.

Her adopted son.

Margaret had taken Andrew in when he was only six years old. From Brooklyn, he was a sharp, lively-eyed boy whose heart immediately won Margaret over. A widow with no children and a strong career in corporate accounting, she believed she could offer him a better life — and she did. She paid for his education, helped him enter the real estate sector, and gave him every opportunity she could.

Now, at 78, Margaret was forced to leave the residence she considered home, located in the peaceful suburb of Millbrook, New York. The house, once filled with laughter, celebrations, and music, now stood cold, silent, and legally out of her hands.

Andrew, adopted 35 years ago, justified his action coldly:

— Mom, you’re not safe here. You forgot to turn off the stove twice this week — he said, handing her the letter. — I’ve already arranged a place for you.

Margaret had hoped to be moved to a comfortable assisted living facility. Instead, she was sent to a modest community home in Poughkeepsie, far from everything she knew.

What Andrew didn’t know — and no one did — was that Margaret had secretly built a financial empire over twenty years. Composed of shell companies, sophisticated trusts, and offshore accounts, her net worth exceeded $100 million. She was not weak, sick, or defeated; she was merely waiting for the right moment.

Two weeks after being evicted, Andrew was celebrating in a Manhattan restaurant:

— Finally! The house is mine — he said to his girlfriend Tara, an influencer who saw philanthropy as mere image. — The old lady didn’t even fight! No lawyers, nothing.

But Andrew didn’t notice the suspicious expression of a waiter, a former intern at the prosecutor’s office where Margaret had worked, who recognized the name “Margaret Whitmore.” He knew the ingenious financial mechanisms she had used but kept silent.

Meanwhile, Margaret was in Poughkeepsie, in a small room, holding a yellowed journal. It wasn’t a regular diary: it contained passwords, contacts, locations of valuable assets, names of trusts, and properties carefully camouflaged with her late husband’s initials.

She didn’t call lawyers or alert Andrew. Instead, she wrote a letter:

*”Dear Andrew,

You were my son and I gave you everything, but you repaid me by taking what was never yours. You overlooked one essential detail: I never put all my resources in a single investment.

Enjoy the house; it’s yours now, but this is just the beginning. You never cared about what I built before you; you simply assumed it. Discover the rest yourself.

With love,

Mom.”*

She sent the letter anonymously and then called Robert, her old ally and silent co-executor:

— Robert? This is Margaret Whitmore. I want to activate Trust 17B. The time has come.

Three weeks later, Andrew was in his new office at the Millbrook house. He threw the old piano into the garden and turned the study into a bar. He planned to sell the property in six months, but problems arose:

The land didn’t belong to Andrew. It was part of a complex trust, hidden under multiple corporate layers linked to a holding company in the Cayman Islands. His lawyer was the first to notice:

— Was your mother an accountant? — he asked.

— Yes. — Andrew replied.

— More than that. She was a silent magnate. We found 15 trusts in her name, six directly related to real estate. You only have partial control of the house. You can live there, but you can’t sell the land.

Andrew was furious. His girlfriend left him, posting on Instagram:

“Some wear Gucci. Others just pretend to own the house.”

Meanwhile, Margaret moved to an elegant condo in Saratoga Springs, part of the already-activated Trust 17B. With Robert, she discreetly redistributed assets. When Andrew tried to locate the main trust, it had already been split into six smaller funds, each with different managers. His name was nowhere in the documents or directives.

The final surprise came: Andrew’s real estate business, heavily indebted, had relied on selling the house. Unable to sell legally, his loans became due, his credit line was frozen, and he faced absolute ruin.

Worse, he received a letter from a philanthropic foundation created by Margaret, the Whitmore Silent Futures Fund, offering only limited, conditional assistance — a humiliating blow for someone who thought himself the heir.

Margaret, meanwhile, enjoyed the holidays, attending ballets in Vienna and living peacefully. In her journal, she wrote:

“He saw me as an old, weak woman. He didn’t understand that true wealth is discreet, and wisdom imperceptible. It was always enough.”

Five years later, Margaret passed away peacefully at 83. Her obituary in The Wall Street Journal revealed the magnitude of her fortune: $107 million in assets distributed across educational entities, women’s investment programs, and scholarships for children in foster care.

Andrew received nothing. The obituary only mentioned:

“No immediate heir survives.”

Margaret had proven that true wealth lies in discretion, preparation, and the wisdom to protect what one has built — even in the face of betrayal and ingratitude.