My stepdaughter invited me to a restaurant — and I was speechless when it came time to pay the bill.

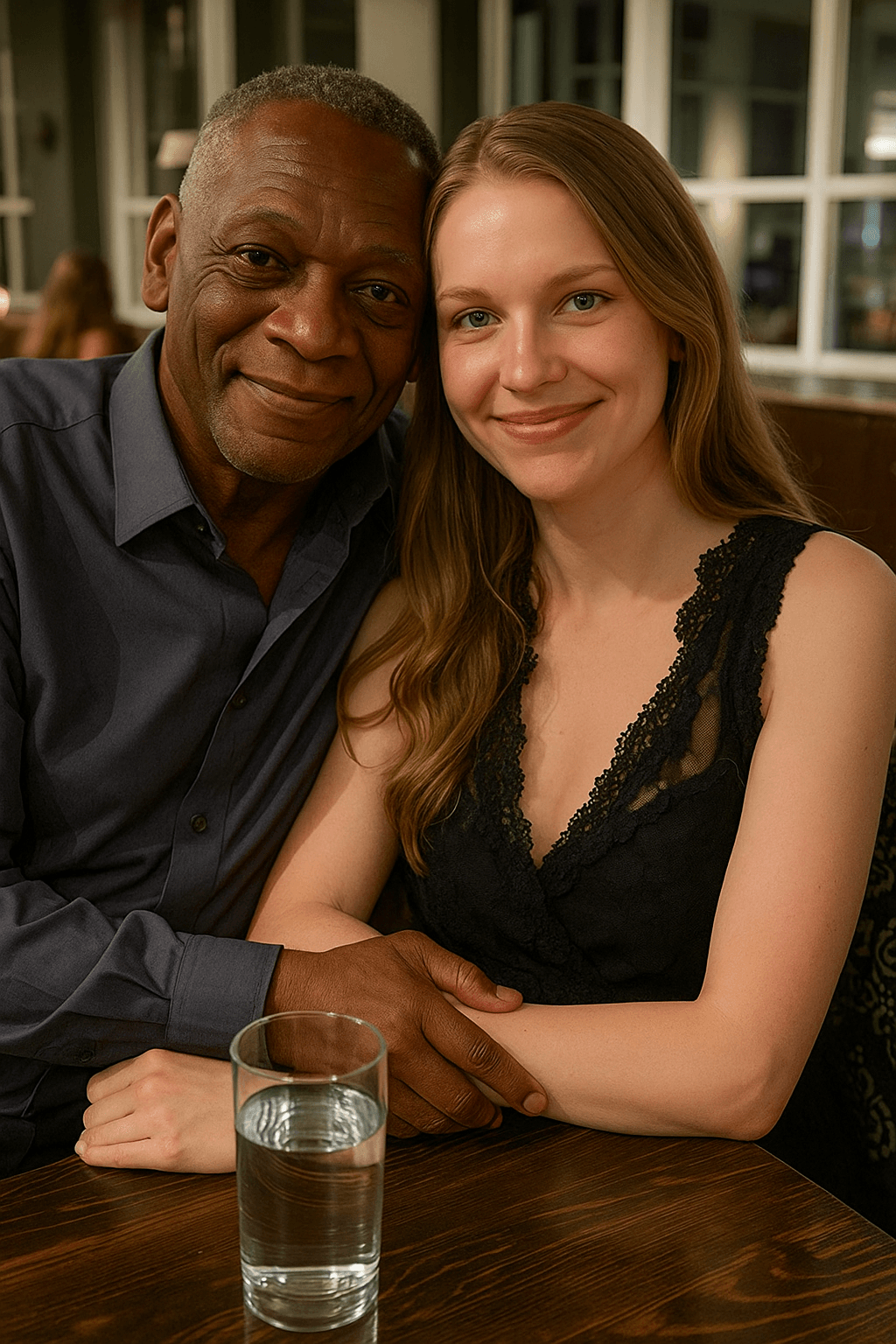

My name is Rufus, I’m 50 years old, and although my life has been calm and predictable, there’s always been an empty space I could never quite fill: my relationship with my stepdaughter, Hyacinth. Ever since I married her mother, Lilith, when Hyacinth was still a teenager, our relationship was marked by distance. She never fully accepted me, and over time, I slowly stopped trying.

It had been over a year since I’d heard anything from her, so when I got her call inviting me to dinner, I must admit my heart filled with hope. Was she trying to reconnect? Start over? I said yes immediately.

The restaurant was elegant—far more upscale than I was used to. When I arrived, Hyacinth was already there, dressed beautifully, wearing a smile that didn’t reach her eyes. The conversation was strange, superficial. She ordered lobster, filet mignon… the most expensive dishes, without even asking if I was okay with it. Despite the uncomfortable atmosphere, I tried to break the ice, start a conversation, show interest. But she barely responded.

At the end of the dinner, I called the waiter and prepared to pay. I picked up the check automatically, but Hyacinth whispered something to the waiter and got up, saying she was going to the restroom. I waited. And waited. But she didn’t come back.

My heart sank. I looked at the bill — it was outrageous. I felt a mix of shame and sadness. I thought: “Did she really use me for an expensive dinner?”

When I stood up to leave, resigned, I heard a noise behind me. I turned and saw Hyacinth returning, holding a huge cake in her hands and colorful balloons floating above her head. She was grinning from ear to ear, like a child about to reveal a secret.

“You’re going to be a grandpa!” she exclaimed.

For a moment, I froze. I tried to process those words. “Grandpa?” I repeated, in disbelief. She nodded, emotional.

“I wanted to tell you in a special way. That’s why I was so weird during dinner — I was nervous,” she explained, holding up the cake. In blue and pink frosting, it said: “Congratulations, Grandpa!”

She told me she had arranged everything with the waiter. She wanted to surprise me. She hadn’t been avoiding me — she had been trying to find a way to show me that she wanted to include me in this new phase of her life.

Her words hit me hard. Hyacinth, so closed off for so many years, was trying to reconcile. And in such a beautiful, symbolic way. I was moved. I couldn’t hold back — I went to her and hugged her. She hesitated for a second, surprised, but then hugged me back tightly.

In that moment, the years of distance began to melt away. I felt that, finally, she accepted me as part of her life.

We left the restaurant with the cake, the balloons, and a new connection between us. For the first time, we were no longer just stepfather and stepdaughter — we were family. And now, with a new member on the way, everything pointed to that bond only growing stronger.

Awareness about Credit Card Use

The credit card is one of the most popular financial tools and, at the same time, one of the most dangerous when misused. At its core, it offers convenience, security, and the ability to delay payments or split purchases into installments — which can be extremely useful in emergencies or well-planned purchases. However, its misuse has led millions of people into debt and financial chaos.

Many people see the credit limit as an extension of their income, when in reality, it is borrowed money that will eventually be charged — usually with added interest if not paid in full. Credit card revolving interest rates are among the highest in the market, often exceeding 400% per year. Just a small delay can make the debt grow significantly and become unpayable in a short time.

In addition, unconscious use of the card can create an illusion of purchasing power. Promotions, interest-free installments, and rewards programs encourage consumption even when there is no need or planning. When several small installments pile up, the total committed amount can spiral out of control and take up a large portion of the monthly income.

That’s why it’s essential to use a credit card responsibly. Before making a purchase, ask yourself: “Do I really need this right now?” and “Can I pay this bill in full when it’s due?” If the answer is no, it might be better to postpone the purchase or find an alternative.

Another important habit is regularly monitoring your bill. Today, with banking apps, it’s possible to view real-time credit card spending. This helps avoid surprises at the end of the month and allows adjustments to be made ahead of time. It’s also wise to avoid having multiple credit cards at once, as that makes control more difficult and increases the risk of debt.

Financial education is the safest path to turning the credit card from a villain into an ally. It can be useful when used with awareness, discipline, and planning. Otherwise, it may become a silent trap that erodes financial stability and compromises dreams.

In summary: a credit card should be seen as a support tool, not a substitute for income. Using it wisely, paying the bill in full, and keeping track of expenses are attitudes that ensure peace of mind and financial freedom in the future.