My husband suggested we separate for a month — then my neighbor called saying: “Come back home, there’s a woman in your bedroom!”

When Derek, my husband, suggested a one-month temporary separation to “reignite our relationship,” I found it strange but agreed. He said it would help us reconnect, miss each other, and appreciate what we had. I thought it was just one of those modern ideas couples try to salvage what’s left. Reluctantly, I packed my suitcase and moved to a rental across town.

The first week, I felt strange and alone. Derek barely texted, and when he did, he said he was “enjoying the space.” Still, I tried to believe he had good intentions. I invited my sister, Penelope, to visit me, and she was blunt:

— Are you sure about this, Lisa? This sounds like an excuse for something else…

— I think so too, but whenever I questioned it, he reacted badly. So I let it go — I replied, trying to hide my own doubts.

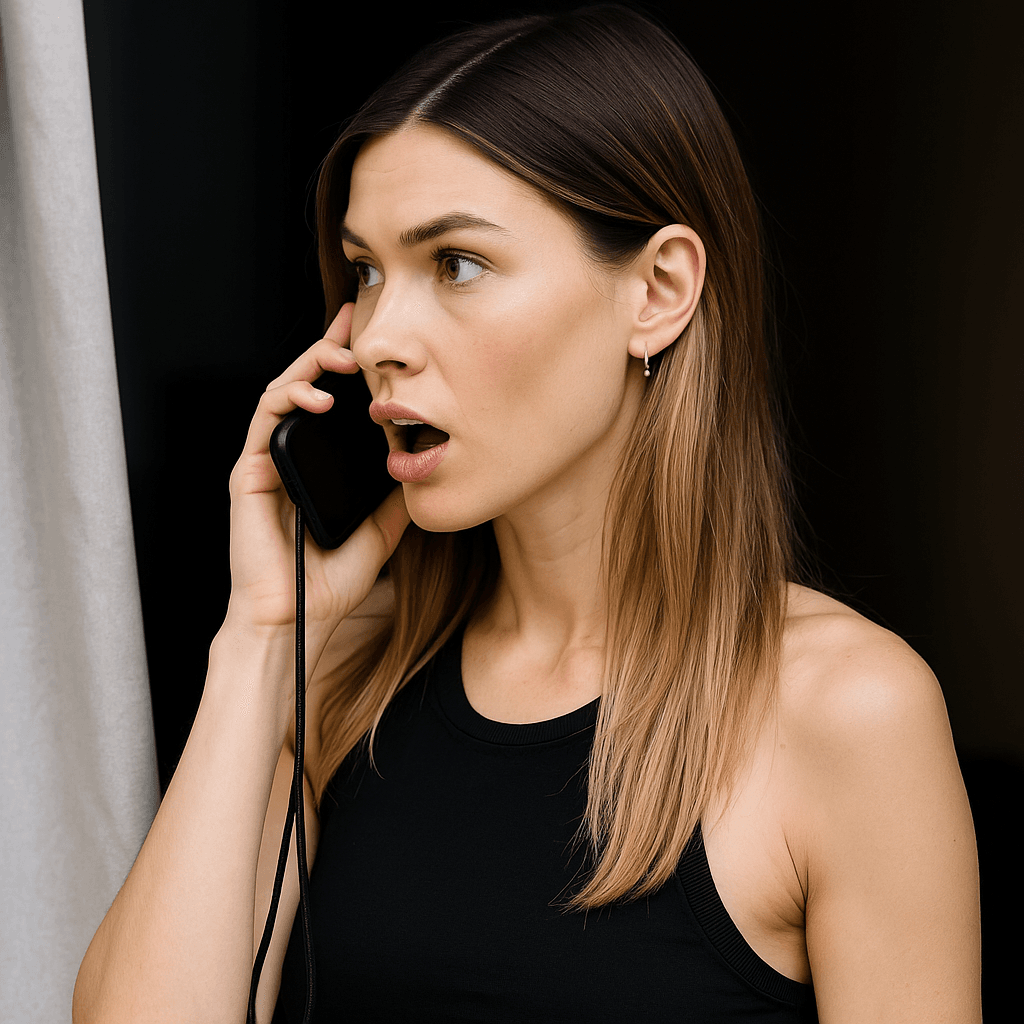

But everything changed on a quiet Saturday night when I got a call from Mary, my neighbor:

— Lisa, come home now! There’s a woman in your bedroom!

My heart raced. I grabbed my keys and ran. I arrived shaking. I pushed the door open and rushed upstairs, my heart pounding. When I opened the bedroom door, I came face-to-face with… Sheila. Derek’s mother.

She was standing, surrounded by my scattered clothes, holding my lace bra with a look of disgust.

— Sheila? What are you doing here?

— Cleaning this house. This isn’t appropriate for a married woman — she replied coldly, throwing my bra to the floor.

I looked around. There were trash bags full of my clothes, my personal belongings rummaged through. I was in shock.

— Who gave you the right to throw my clothes away?

— Derek asked me to put the house in order while you were gone. He agrees with me. This isn’t a wife’s life. He deserves better.

I felt my anger boil. When Derek arrived, I was still shaken. He looked at me like I was the one in the wrong.

— What are you doing here, Lisa?

— Your mother is in our bedroom, throwing away my things. And you let her!

He sighed, as if he was tired of my “dramatization.”

— Mom was just trying to help. You’ve been so stressed… the house is a mess, there are crumbs in the bed…

— Because YOU eat in bed, Derek! — I shouted.

— Don’t blame me for everything!

— You lied! You said this time was to help us reconnect, and instead, you brought your mother in to replace me as the housewife!

Derek tried to justify himself, saying he was “trying to help,” that he didn’t mean to hurt me. But to me, it was clear: he didn’t want a partner. He wanted a servant. And the cherry on top was letting his mother invade my space as if she owned the house.

That same night, I grabbed the few clothes I had left, packed my suitcase, and left. Three days later, I contacted a lawyer.

Many would say I overreacted, but it wasn’t just about the clothes or the humiliation. It was about the clarity of what I truly was to Derek: disposable, a background character in my own marriage.

I’m now living with Penelope while the divorce is being processed. I intend to fight for what’s rightfully mine. If Derek thought he could treat me like an invisible maid and then move on with life as if nothing happened, he was very wrong.

— What was the worst part of all this for you, sis? — Penelope asked one night.

— Realizing my husband saw me as a failure. That deep down, he never saw me as his equal.

She sighed, placing the pizzas in the oven:

— I always knew Derek was the biggest mistake of your life.

I smiled for the first time in days.

— Maybe he was. But now, it’s a mistake I’m fixing.

And that, finally, was the real reactivation of my life — but without Derek.

Credit Card Awareness Text

A credit card can be a powerful financial tool, but it can also become a dangerous trap if not used responsibly. The ease of buying now and paying later often leads us to lose control over our spending. It’s important to remember that your credit card limit is not an extension of your income, but a line of credit that, if used without planning, can compromise your budget for months — or even years.

Many consumers end up paying only the minimum amount of the bill, without realizing that this puts them in a cycle of debt. Credit card revolving interest rates are among the highest in the market, exceeding 400% per year. This means that a small debt can quickly become a major problem.

Additionally, impulsive credit card use can create the illusion that it’s possible to maintain a lifestyle beyond your financial reality. Installment purchases pile up and, before you know it, a large portion of your monthly income is already committed to paying off your card. This leads to a loss of control over your budget and often to default.

That’s why it’s essential to adopt good credit card practices:

- Set a monthly usage limit that aligns with your financial reality, even if the bank has approved a higher limit.

- Always pay the full bill amount by the due date.

- Avoid long-term installments and, especially, impulse purchases.

- Track your spending daily using apps or spreadsheets to know exactly where your money is going.

- Use the card as an organizational tool, not as a solution to cover expenses you can’t afford with your income.

Remember: the credit card can be an ally, but only if used with awareness, planning, and control. Your financial freedom depends on your daily choices.