Mother Sacrifices Everything for Her Children, Gets Kicked Out by Them, and Ends Up Becoming a Millionaire

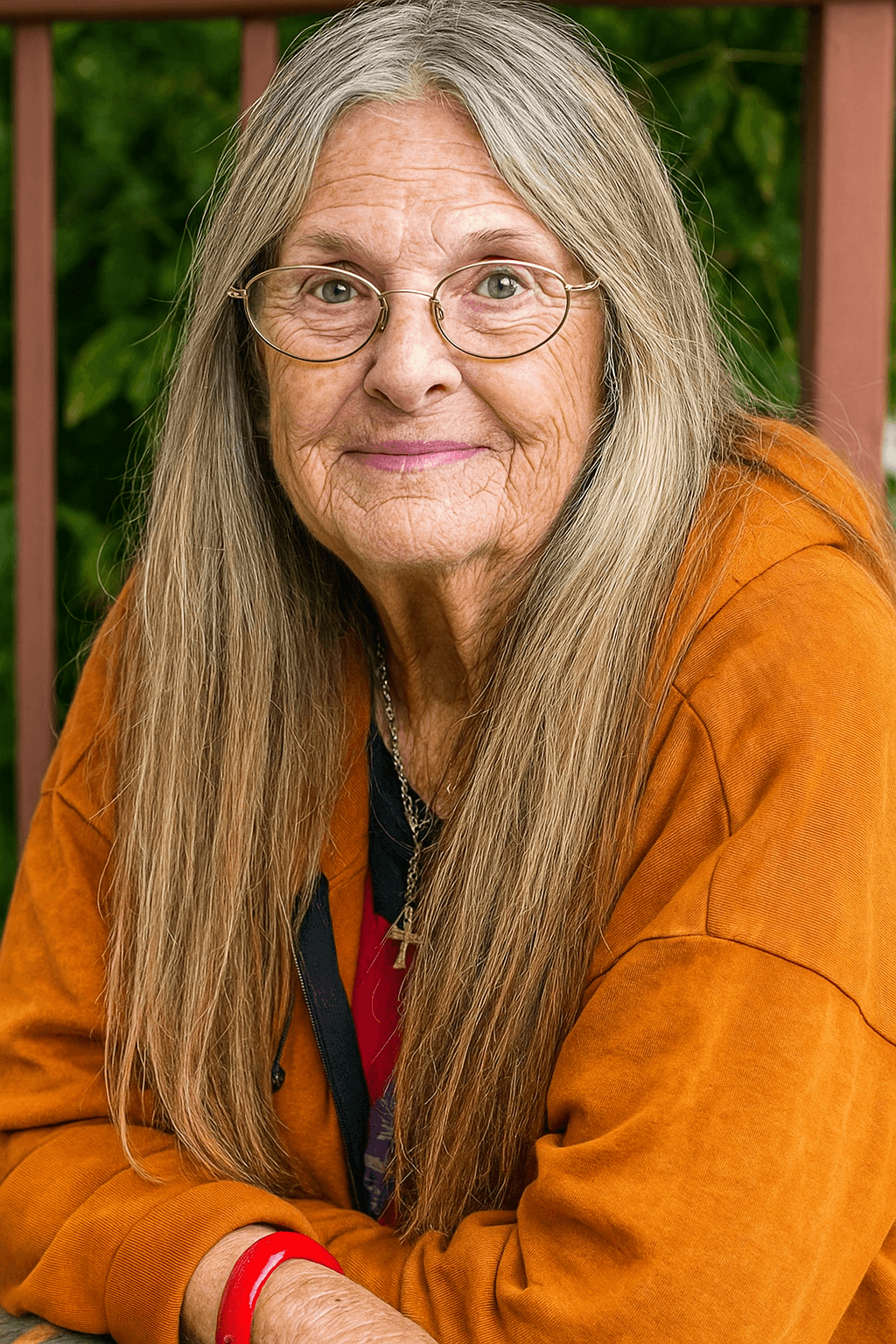

Olive had always been a simple woman with a big heart. Since the birth of her twin sons, Cole and Elijah, she and her husband Todd dreamed of a bright future for their family. With no formal education, Todd worked as a livestock caretaker on a small ranch, while Olive stayed at home taking care of the house and the boys. Even with limited resources, the couple had a clear goal: to see their children graduate and succeed.

“My sons are going to save lives,” Todd used to say proudly, cradling the newborn twins in his arms.

But life took a cruel turn. Years later, Todd tragically died in a buffalo stampede. Olive, now a widow, found herself alone, in debt, and raising two teenagers. Bills piled up, and local landowners began offering large sums to buy the family’s land.

Still, Olive stood her ground. Determined to honor her husband’s dream, she started working as a housekeeper at the mansion of a wealthy and reserved man named Mr. Williams. Her work was flawless, and her kindness quickly caught her employer’s attention. He began to pay her more generously. Every penny she earned was saved to fund her sons’ education.

With great sacrifice, Cole and Elijah managed to get into medical school. Though not passionate about the field, they pursued it to please their parents—or perhaps for future personal gain.

Later, a wealthy landowner approached the twins with a tempting offer: to buy the family ranch for a small fortune. Seduced by the promise of easy wealth, the brothers tried to convince their mother.

“Mom, we’ve thought it through and decided to accept John’s offer to sell the land,” Cole said during dinner.

Olive paused mid-meal, looked them in the eye, and replied firmly:

“I will never sell that land.”

“But Mom, we need the money,” Elijah insisted. “This could change our lives.”

“That land is all we have left of your father. It is not for sale.”

The very next day, with legal backing and cold determination, the sons evicted Olive from her own home. They suggested she move in with her siblings—who also refused to take her in. With nowhere to go, Olive sought shelter in a homeless shelter.

Even while heartbroken, she continued working for Mr. Williams. She split her days between the mansion and the shelter, always with humility and grace. Over time, she won the affection of everyone there.

One morning, she arrived at work only to find a somber atmosphere. Mr. Williams had passed away.

Devastated, Olive believed she had not only lost her job, but the last pillar holding her life together. She returned to the shelter with a heavy heart—unaware that something extraordinary was about to happen.

A few days later, a luxury car pulled up in front of the shelter. A lawyer stepped out, asked for Olive, and said:

“Mr. Williams left his entire fortune to you. But there is one condition: you may not share this money with your children, siblings, or anyone who abandoned you.”

Overcome with emotion, Olive accepted. With the inheritance, she renovated the shelter, bought medicine, clothing, and food. She began helping other women and elderly people in vulnerable situations. There, surrounded by those who truly cared, she built a new family.

A few months later, Cole and Elijah came knocking. They had found out their mother had become a millionaire. Remorseful—or perhaps just greedy—they asked for forgiveness and tried to reconnect.

But Olive calmly replied:

“My fortune is not for you. It’s for my real family—those who stood by me when I needed them most.”

And so, Olive, the woman rejected by her own sons, proved that true wealth lies in gratitude, dignity, and loyalty.

📊 Financial Planning Awareness

Many people live paycheck to paycheck simply because they don’t know where their money goes. Financial planning is the roadmap that organizes your economic life, helps you reach your goals, and prevents unnecessary debt. Without it, your salary disappears before the month ends.

Planning your finances doesn’t require complex formulas. With organization and discipline, anyone can:

📌 How to Start:

- Write down every expense, no matter how small.

- Divide your budget into categories: essentials, non-essentials, and priorities.

- Set monthly savings and investment goals.

- Build an emergency fund covering at least 3 to 6 months of expenses.

- Cut back on excess and rethink your spending habits.

Planning is the first step to achieving financial freedom. Without planning, there’s no progress.