“I Saw a Lost Child at the Airport — What Was in His Backpack Took My Breath Away”

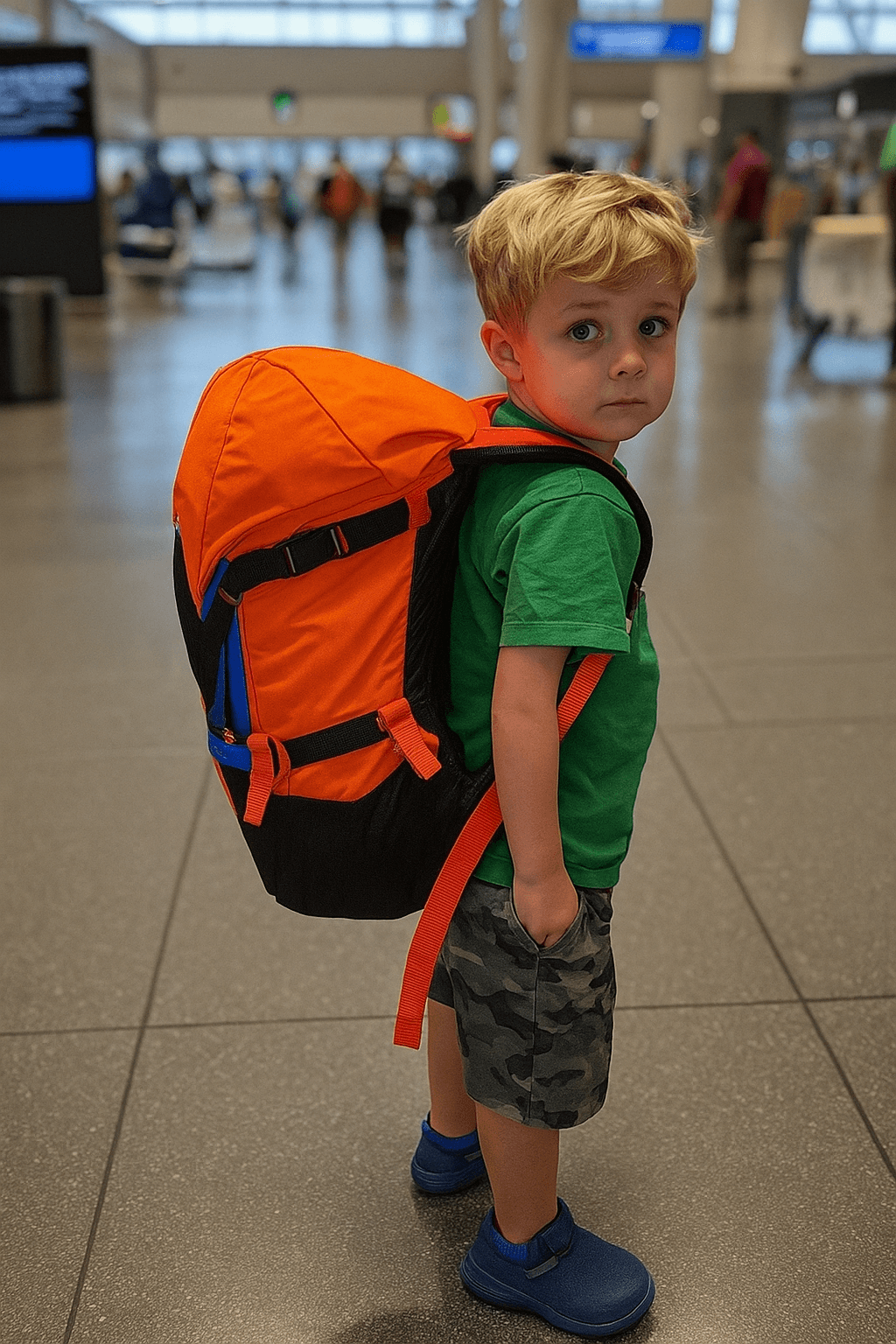

Two weeks ago, while waiting for my flight at a busy airport, I saw a child walking alone among the passengers. He was a boy of about six, clutching his backpack as if it were the only thing keeping him safe in that chaos. I couldn’t ignore that scene.

I had already been at that terminal for over four hours, and between coffees and failed attempts to kill time, I noticed the boy wandering aimlessly. There were no parents nearby, no one calling for him. Just him, lost in the crowd. His eyes were wide, but he was trying hard not to cry. That look… I knew it well. It was the look of someone trying to be brave, even though they were scared.

I instinctively stood up and carefully approached.

— Hey, buddy — I said gently, so as not to frighten him —, are you okay?

He stopped. For a moment, I thought he might run, but he just stood there, gripping his backpack tightly, as if it were a shield. After a moment, he gave a shy nod.

— What’s your name?

— Tommy — he whispered.

I crouched down to be at his eye level.

— Do you know where your parents are? Or is there something in your backpack that might help me find them?

He nodded hesitantly and handed me the backpack. I opened it and looked for a boarding pass, an ID tag, any clue. I found a crumpled airline ticket with his full name. When I read the last name, I froze.

“Harrison.”

My last name.

I looked at the boy again. His features — the nose, the eyes, even the chin — were oddly familiar. But that was impossible. I don’t have children. I barely speak to my own family. Then a memory hit me like a punch to the gut: Ryan.

My missing brother. He vanished from my life years ago, without explanation. He just left, taking everything with him — answers, affection, and the few ties that remained in our family.

— Tommy… who’s your dad?

He looked away.

— He’s here… at the airport.

— Do you know his name?

Tommy hesitated, then simply said:

— He’s my dad.

The answer was vague, but something deep inside me tightened. I stood up.

— Let’s find security. They can help.

As we walked, a man came running toward us, scanning the crowd. And then he saw us. And I saw him.

Ryan.

His face more worn than I remembered, deep dark circles under his eyes, an unshaven beard. He looked like he had aged a decade. His eyes locked onto Tommy. Then onto me.

— Dad! — Tommy shouted, trying to let go of my hand.

Ryan ran to us and dropped to his knees in front of his son.

— Tommy! Oh my God! — He pulled him into a tight hug, visibly relieved.

When his eyes met mine, the shock was clear.

— I… I can’t believe it — he stammered. — Thank you for staying with him.

I nodded, still trying to process the whirlwind of emotions hitting me. Years of silence, hurt, and distance stood between us. A chasm.

— Is he… my nephew? — I asked, unable to hold back.

Ryan took a while to respond, but finally nodded.

— Yes. He is.

My heart tightened.

— I wish I had known — I murmured.

Ryan lowered his head.

— I didn’t know how to tell you. I didn’t know how to come back.

We fell silent. For the first time in a long time, there were no words. Just a quiet understanding. Life had taken us down different paths, but in that moment, something had shifted. Chance — or maybe fate — had brought us together there, at that airport.

— Well… — I took a deep breath. — Maybe this is a good time to start over.

Ryan looked at me, surprised, as if he hadn’t expected an opening.

— Would you accept that? — he asked, his voice trembling.

I looked at Tommy, who held his father’s hand tightly but also glanced at me with a curious, almost hopeful look.

— For him, yes. — I smiled. — And for us too.

Ryan nodded, moved. We didn’t solve everything right then, but something reconnected. And that was already a beginning.

After all, sometimes you need to get lost — or find a lost child — to find your way back home.

Credit Card: Freedom or Trap?

We live in an increasingly digital society, where the credit card has become one of the most popular means of payment. It offers speed, security, and benefits like installment purchases and loyalty programs. However, despite all these advantages, the credit card can become one of the biggest villains of personal finances if not used responsibly and consciously.

Many consumers make a common mistake: they see the card limit as an extension of their monthly income. This mindset leads to expenses that, in reality, don’t fit within the budget. And the problem starts when the bill arrives — and the amount is higher than expected. At that point, the consumer may resort to the minimum payment, which activates the dreaded revolving credit, with interest rates among the highest in the financial market.

What starts as a small imbalance can turn into a snowball. Debts not paid off quickly accumulate compound interest, fines, and charges, making it increasingly difficult to regain control. As a result, the credit card — which should be a convenience tool — becomes a source of stress, anxiety, and financial chaos.

Becoming aware of how to use a credit card starts with a mindset shift. Instead of thinking “I can pay later,” one should ask, “Do I have the money for this now?” Buying with a card doesn’t eliminate the expense — it only delays payment. And without planning, that delay can be costly.

Some essential practices for healthy credit card use include:

- Planning monthly expenses: Before using the card, assess whether the expense fits the budget and whether it will be possible to pay the full amount on the next bill.

- Avoiding long-term installments: Spreading payments over many months compromises future income and makes financial control difficult. Always assess the impact of each installment.

- Monitoring expenses in real-time: Use your bank or card app to check transactions daily. This helps avoid bill surprises.

- Having a limit compatible with your income: A very high limit can encourage overspending. Adjusting the limit to your budget is a form of protection.

- Always paying the full bill amount: Never pay only the minimum. That automatically activates revolving credit, generating high interest and increasing your debt month by month.

Also, it’s important to know that your credit card usage history directly impacts your credit score. Good use — with on-time payments and spending control — can open doors to loans, lower-interest financing, and even exclusive offers. On the other hand, delays and defaults reduce the consumer’s credibility in the market.

Financial education is an essential step in turning the credit card into an ally, not an enemy. Reading about how credit works, watching educational videos, and, if possible, talking to a finance expert can help you develop more conscious and balanced habits.

In short: the credit card is not the villain. The problem lies in unconscious, impulsive, or uninformed use. With discipline, planning, and knowledge, it’s possible to enjoy all the benefits it offers without falling into the debt trap. Make your credit card a tool for financial freedom — not a debt prison you can’t escape.